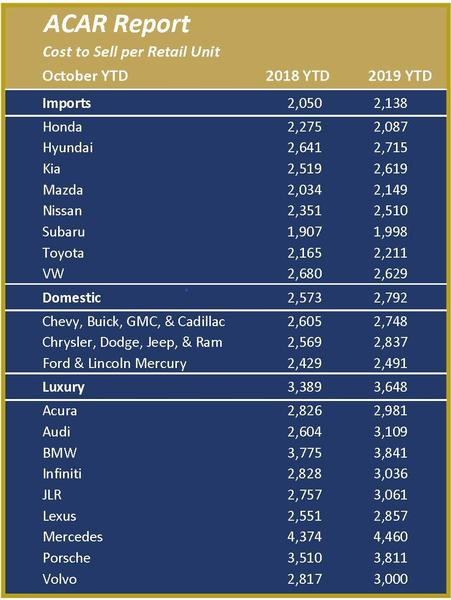

Forecast Essentials – It Costs $2,400 to Sell a Vehicle

April 23, 2020

Do you know how much it costs to sell a vehicle in your dealership? Very few dealers realize that the average cost to sell a vehicle is $2,400. In my discussions, I have found that most managers and dealers assume the cost to sell is $600 - $1200.

To calculate your cost to sell, take your total new & used expenses on your factory financial statement and divide by total retail units. Depending on the manufacturer, this number has already been reduced by advertising and floor plan credits.

Read More...

To calculate your cost to sell, take your total new & used expenses on your factory financial statement and divide by total retail units. Depending on the manufacturer, this number has already been reduced by advertising and floor plan credits.

ACAR Articles

published in Auto Success Magazine

We are passionate about the automotive industry at ACAR and it is our goal to stay informed and educate dealers about what is current in the world of autosales to maximize profits and save time.

Report Card Make Your Dealership Work for You

Â

Read More...

Report Card Make Your Dealership Work for You

Â

State of the Industry - September 2016 YTD

November 01, 2016

I just finished a webinar for DealersEdge on budgeting and in preparation I completed an analysis of all of our dealers thru September 2016.Â

The numbers were very interesting, so I wanted to share them.  In total our dealers are less profitable by about 10% for Domestic and Import and our Luxury dealers are down 28%.

As I dig into the numbers for Domestic and Import, overall gross is up 7%, new volume up 5% and used volume up 11%, but our selling expenses are up 11% and overhead is up 10%.  The increase in overhead expense was the biggest surprise.  It does support what we have been seeing everywhere, new & used gross per unit is down, therefore there is not enough gross to support the additional expenses.

As you build your forecasts for 2017, look for ways to increase gross while controlling expenses.  If we have a down turn, it will throw a number of dealerships into losses.  Overall, front end gross is going away and F & I is growing, but the additional F & I gross is just covering the increased employee cost over the last two years.  Gross doesn’t need to go down, we still have a number of clients that get strong gross and have strong market share.  These are not mutually exclusive; you just have to build a culture in your store on the importance of gross.  It takes a while to make that change, but it is well worth it.  If you take out your 2016 ACAR Report and see you are making less after making all those additional sales, it is disappointing.

An example of strong gross is our Toyota dealers.  Not only is new volume up 5%, but new gross is up 7%, and Toyota has the new DAP income which if included in new car gross, would cause gross to be up 13%.  This is just one example; we have a number of dealers still excelling in gross.Â

In general, items that help increase gross are:

In summary, there are a lot of positives in the market, but as we look at 2017, make sure you are not leaving profits on table.  A fine-tuned operation is key to attacking a down turn.

We will be sending our annual Profit Planners this month.  Be sure to give us a call if you have any questions at 1-888-409-2227.

Read More...

The numbers were very interesting, so I wanted to share them.  In total our dealers are less profitable by about 10% for Domestic and Import and our Luxury dealers are down 28%.

As I dig into the numbers for Domestic and Import, overall gross is up 7%, new volume up 5% and used volume up 11%, but our selling expenses are up 11% and overhead is up 10%.  The increase in overhead expense was the biggest surprise.  It does support what we have been seeing everywhere, new & used gross per unit is down, therefore there is not enough gross to support the additional expenses.

As you build your forecasts for 2017, look for ways to increase gross while controlling expenses.  If we have a down turn, it will throw a number of dealerships into losses.  Overall, front end gross is going away and F & I is growing, but the additional F & I gross is just covering the increased employee cost over the last two years.  Gross doesn’t need to go down, we still have a number of clients that get strong gross and have strong market share.  These are not mutually exclusive; you just have to build a culture in your store on the importance of gross.  It takes a while to make that change, but it is well worth it.  If you take out your 2016 ACAR Report and see you are making less after making all those additional sales, it is disappointing.

An example of strong gross is our Toyota dealers.  Not only is new volume up 5%, but new gross is up 7%, and Toyota has the new DAP income which if included in new car gross, would cause gross to be up 13%.  This is just one example; we have a number of dealers still excelling in gross.Â

In general, items that help increase gross are:

-

Having the correct inventory

-

Looking at front end gross separately from F & I gross and manufacturer income

-

Having an understanding of how much it costs to sell a car (usually at least $2,000)Â Â Â Â Â Â Â Â Â Â Â

-

Realizing that you have a product people want and that it isn’t always about price

-

Training your sales staff and managers the value of the vehicle and your dealership

-

When gross goes up, usually market share goes up, because morale goes up

In summary, there are a lot of positives in the market, but as we look at 2017, make sure you are not leaving profits on table.  A fine-tuned operation is key to attacking a down turn.

We will be sending our annual Profit Planners this month.  Be sure to give us a call if you have any questions at 1-888-409-2227.

October 2010 in Review

November 19, 2010

Again and again, it seemed like everyone had a strong used car month as I reviewed October’s ACAR Reports.  Not only gross, but sales volume too.  The timing couldn’t be better since it is the best time of the year to get the used inventory clean as you enter November and December. Aside from used car sales I didn’t see any strong consistencies in other departments. Overall dealers had a good month.Â

Â

One of our high end dealers had their best month ever in volume, gross and net profit.  Chrysler Dodge and Jeep dealers continue to build their profitability. Keep cleaning the inventories and take advantage of year end marketing opportunities.

Read More...

Â

One of our high end dealers had their best month ever in volume, gross and net profit.  Chrysler Dodge and Jeep dealers continue to build their profitability. Keep cleaning the inventories and take advantage of year end marketing opportunities.

July in Review... Increased Volume - Huge Profits

August 17, 2010

As we wrap up the July ACAR Reports, my first thought is increased volume equals big profits.  A number of dealers had a very profitable July, several with record profits.  With all of the cutbacks over the last two years, the expense structure is drilled in and increased gross is flowing to the bottom line.

Not everyone had a big month, but it was much better than June.  It was by far the best overall month since March.  I know a lot of dealers were very focused on how to keep 2010 profits up over 2009 profits as they entered the months where we had Cash for Clunkers last year.  It will be interesting to see how August compares.

It has still been a strange year.  There is no definitive trend that says the majority of new sales are up or used sales are down for dealers.  Each individual dealership, regardless of manufacturer, is making gains in different directions.  It depends on their market, strengths and where they are focusing the most attention.  Each dealership needs to determine what ingredients work for them.

We are now preparing an increased number of projections for dealers looking to add dealerships due to many of our customers having sold or closed their weaker locations.  We have, and can, prepare a historical analysis and build an ACAR Profit Planner for the future as you go forward and analyze these opportunities.Â

As you go into August, I suggest watching your used inventories as you enter the last quarter and make sure everything over 60 days old is gone.  Don’t start hiring a bunch of employees or loosen your grip on the purse strings because you have had a couple of good months.  It could be a very bleak 4th quarter, so stay lean and make sure you are banking your current profits.

Â

Keep Focused and Have a Great August.

Read More...

Not everyone had a big month, but it was much better than June.  It was by far the best overall month since March.  I know a lot of dealers were very focused on how to keep 2010 profits up over 2009 profits as they entered the months where we had Cash for Clunkers last year.  It will be interesting to see how August compares.

It has still been a strange year.  There is no definitive trend that says the majority of new sales are up or used sales are down for dealers.  Each individual dealership, regardless of manufacturer, is making gains in different directions.  It depends on their market, strengths and where they are focusing the most attention.  Each dealership needs to determine what ingredients work for them.

We are now preparing an increased number of projections for dealers looking to add dealerships due to many of our customers having sold or closed their weaker locations.  We have, and can, prepare a historical analysis and build an ACAR Profit Planner for the future as you go forward and analyze these opportunities.Â

As you go into August, I suggest watching your used inventories as you enter the last quarter and make sure everything over 60 days old is gone.  Don’t start hiring a bunch of employees or loosen your grip on the purse strings because you have had a couple of good months.  It could be a very bleak 4th quarter, so stay lean and make sure you are banking your current profits.

Â

Keep Focused and Have a Great August.