Return To Blog

Avoid Phantom Floorplan Assistance Income, Change It Now

August 24, 2021

Do you record floorplan assistance when the vehicle is received? If so, with such low inventories, this is the time to change.

Traditionally assistance is recorded as income when the vehicle is booked into inventory, sometimes before the vehicle arrives at the dealership. Â

We recommend realizing income when the vehicle is sold. Individuals paid on that revenue should be rewarded when the sale is made, not by increasing your inventory. Â Also, when floorplan assistance is not matched with sales, it makes unfavorable months look more profitable than actual. Â Rebates and dealer cash are recorded when you sell the vehicle, so why not interest credits.

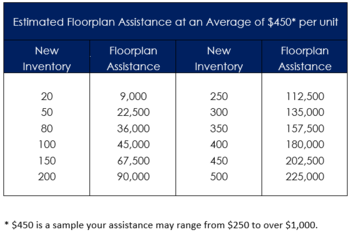

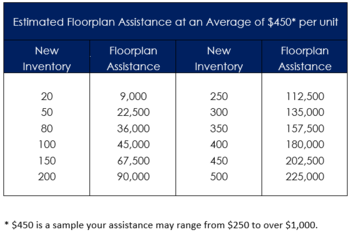

It is a difficult process to initiate since you usually have high volumes of inventory, which makes for a sizable adjustment to income. Â If you normally have 200 new units in inventory and your average floorplan assistance is $450 you have already recorded $90,000 of income without a sale. Â

With these abnormally low inventories it renders the process painless. Â For example: with only 20 new units in inventory with average floorplan assistance of $450 you only have $9,000 of unrealized income, much easier to reverse than $90,000. Â See estimated reserves below. Â In this example if your inventory goes up 100 vehicles in December you will have $45,000 of income, just because your inventory increased.

Switch to recognizing floor plan assistance when you sell the vehicle by taking your unrealized income and setup an interest assistance reserve account with the $9,000 initial adjustment which you offset against floorplan assistance income.  The reserve account can be a contra receivable account setup in assets or a reserve setup as a current liability account.  Whenever you record an invoice, you will record your floorplan interest assistance to that account, and it will have no effect on income.  At the end of the month calculate your reserve balance by multiplying your ending new inventory units by your average inventory assistance.  Take the difference to floorplan assistance income.  Now income will be recognized when you sell the vehicle.  Please discuss with your tax advisor regarding tax issues.  Note – your DMS provider may have an automated solution.

Once converted to this method, income will be recognized when earned and pay plans will be based on generating profits and not by ordering more inventory.

Â

Traditionally assistance is recorded as income when the vehicle is booked into inventory, sometimes before the vehicle arrives at the dealership. Â

We recommend realizing income when the vehicle is sold. Individuals paid on that revenue should be rewarded when the sale is made, not by increasing your inventory. Â Also, when floorplan assistance is not matched with sales, it makes unfavorable months look more profitable than actual. Â Rebates and dealer cash are recorded when you sell the vehicle, so why not interest credits.

It is a difficult process to initiate since you usually have high volumes of inventory, which makes for a sizable adjustment to income. Â If you normally have 200 new units in inventory and your average floorplan assistance is $450 you have already recorded $90,000 of income without a sale. Â

With these abnormally low inventories it renders the process painless. Â For example: with only 20 new units in inventory with average floorplan assistance of $450 you only have $9,000 of unrealized income, much easier to reverse than $90,000. Â See estimated reserves below. Â In this example if your inventory goes up 100 vehicles in December you will have $45,000 of income, just because your inventory increased.

Switch to recognizing floor plan assistance when you sell the vehicle by taking your unrealized income and setup an interest assistance reserve account with the $9,000 initial adjustment which you offset against floorplan assistance income.  The reserve account can be a contra receivable account setup in assets or a reserve setup as a current liability account.  Whenever you record an invoice, you will record your floorplan interest assistance to that account, and it will have no effect on income.  At the end of the month calculate your reserve balance by multiplying your ending new inventory units by your average inventory assistance.  Take the difference to floorplan assistance income.  Now income will be recognized when you sell the vehicle.  Please discuss with your tax advisor regarding tax issues.  Note – your DMS provider may have an automated solution.

Once converted to this method, income will be recognized when earned and pay plans will be based on generating profits and not by ordering more inventory.

Â