4th Quarter will Make or Break 2023 - Are you Ready?

October 4, 2023

Planning for the final quarter of the year is crucial to ensuring that you meet your net profit expectations for 2023.

Develop a clear forecast with manager buy-in:

If you need a fresh perspective on how to build profitability, please do not hesitate to reach out. 1-888-409-ACAR (2227)

ACAR's Quarterly Profit Planner quickly assists in producing a road map in building the 4th Quarter plan to meet your 2023 expectations.

Read More...

Develop a clear forecast with manager buy-in:

- Is gross per unit and gross % of sales high enough, are you letting gross walk out the door? Make sure to set the bar high enough.

- Are your goals specific, measurable & realistic?

- Do you have the correct inventory and mix needed to meet goals?

- Does your current expense structure allow you to achieve the net profit you envision?

- What changes need to be implemented to achieve your forecast?

If you need a fresh perspective on how to build profitability, please do not hesitate to reach out. 1-888-409-ACAR (2227)

ACAR's Quarterly Profit Planner quickly assists in producing a road map in building the 4th Quarter plan to meet your 2023 expectations.

Avoid Phantom Floorplan Assistance Income, Change It Now

August 24, 2021

Do you record floorplan assistance when the vehicle is received? If so, with such low inventories, this is the time to change.

Traditionally assistance is recorded as income when the vehicle is booked into inventory, sometimes before the vehicle arrives at the dealership. Â

We recommend realizing income when the vehicle is sold. Individuals paid on that revenue should be rewarded when the sale is made, not by increasing your inventory. Â Also, when floorplan assistance is not matched with sales, it makes unfavorable months look more profitable than actual. Â Rebates and dealer cash are recorded when you sell the vehicle, so why not interest credits.

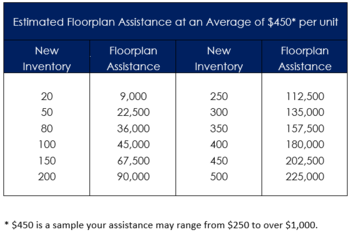

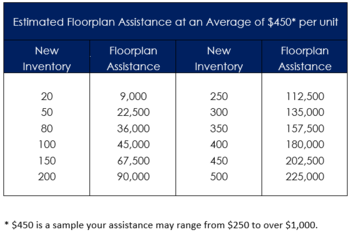

It is a difficult process to initiate since you usually have high volumes of inventory, which makes for a sizable adjustment to income. Â If you normally have 200 new units in inventory and your average floorplan assistance is $450 you have already recorded $90,000 of income without a sale. Â

With these abnormally low inventories it renders the process painless. Â For example: with only 20 new units in inventory with average floorplan assistance of $450 you only have $9,000 of unrealized income, much easier to reverse than $90,000. Â See estimated reserves below. Â In this example if your inventory goes up 100 vehicles in December you will have $45,000 of income, just because your inventory increased.

Switch to recognizing floor plan assistance when you sell the vehicle by taking your unrealized income and setup an interest assistance reserve account with the $9,000 initial adjustment which you offset against floorplan assistance income.  The reserve account can be a contra receivable account setup in assets or a reserve setup as a current liability account.  Whenever you record an invoice, you will record your floorplan interest assistance to that account, and it will have no effect on income.  At the end of the month calculate your reserve balance by multiplying your ending new inventory units by your average inventory assistance.  Take the difference to floorplan assistance income.  Now income will be recognized when you sell the vehicle.  Please discuss with your tax advisor regarding tax issues.  Note – your DMS provider may have an automated solution.

Once converted to this method, income will be recognized when earned and pay plans will be based on generating profits and not by ordering more inventory.

Â

Read More...

Traditionally assistance is recorded as income when the vehicle is booked into inventory, sometimes before the vehicle arrives at the dealership. Â

We recommend realizing income when the vehicle is sold. Individuals paid on that revenue should be rewarded when the sale is made, not by increasing your inventory. Â Also, when floorplan assistance is not matched with sales, it makes unfavorable months look more profitable than actual. Â Rebates and dealer cash are recorded when you sell the vehicle, so why not interest credits.

It is a difficult process to initiate since you usually have high volumes of inventory, which makes for a sizable adjustment to income. Â If you normally have 200 new units in inventory and your average floorplan assistance is $450 you have already recorded $90,000 of income without a sale. Â

With these abnormally low inventories it renders the process painless. Â For example: with only 20 new units in inventory with average floorplan assistance of $450 you only have $9,000 of unrealized income, much easier to reverse than $90,000. Â See estimated reserves below. Â In this example if your inventory goes up 100 vehicles in December you will have $45,000 of income, just because your inventory increased.

Switch to recognizing floor plan assistance when you sell the vehicle by taking your unrealized income and setup an interest assistance reserve account with the $9,000 initial adjustment which you offset against floorplan assistance income.  The reserve account can be a contra receivable account setup in assets or a reserve setup as a current liability account.  Whenever you record an invoice, you will record your floorplan interest assistance to that account, and it will have no effect on income.  At the end of the month calculate your reserve balance by multiplying your ending new inventory units by your average inventory assistance.  Take the difference to floorplan assistance income.  Now income will be recognized when you sell the vehicle.  Please discuss with your tax advisor regarding tax issues.  Note – your DMS provider may have an automated solution.

Once converted to this method, income will be recognized when earned and pay plans will be based on generating profits and not by ordering more inventory.

Â

ACAR Report Notes – June

June 8, 2020

With early results in, it looks like May is showing a strong rebound. New inventory levels are very low, so make sure you are getting all the gross.

As the country opens and PPP wraps up it is time to evaluate our staffing needs thru the end of the year. We suggest building to what an average month will look like.

Concerns:

Read More...

As the country opens and PPP wraps up it is time to evaluate our staffing needs thru the end of the year. We suggest building to what an average month will look like.

Concerns:

Furloughed employees – who and when to bring back

PPP wrapping up – no longer necessary to manage headcounts and compensation

Â

Opportunities:

PPP wrapping up – no longer necessary to manage headcounts and compensation

Â

With high unemployment a good time to upgrade your staff

Re-Design Pay Plans – sales, gross and CSI components

Re-Distribute duties

Re-Align workspaces, counters, and offices for efficiency

Eliminate mediocre employees (unless legal reasons prevent)

Â

Re-Design Pay Plans – sales, gross and CSI components

Re-Distribute duties

Re-Align workspaces, counters, and offices for efficiency

Eliminate mediocre employees (unless legal reasons prevent)

Â

In discussion with dealers, the new hours have been very beneficial and are changing staffing needs. Be very thoughtful as you begin increasing hours. If it does not generate gross or market share to cover those additional costs, do not change those hours.

Also, with changes in processes and new technologies implemented in the last two months there are shifting expectations. For example, salespeople traditionally need to average at least 11 units per month. Should that now be 15 or 20 with more appointment setting and at home deliveries? Is it time to try a new approach?

List duties by position so you can see if the appropriate person is responsible for those duties. I have heard many stories about indispensable employees and once they were furloughed, it turns out they were not needed in the first place.

As you break out responsibilities verify that highly compensated employees are only doing high level work. If someone at $14 an hour can perform the duties of an $8,000 a month person, they should be performing those tasks. For example, an “A†tech should not be working on reconditioning. By moving duties to the appropriate position, it will free up managers to be better utilized or allow you to work with fewer

managers.

As our dealers have been forced to change, they are seeing surprising results and will be changing processes significantly going forward. Make sure you are making a To Do List to keep implementing these changes. As you work thru your new staffing needs please use the Re-Focus Profit Planner for the listing of your employee head counts and compensation. Also, we have templates to inventory all positions in the dealership

and compare back to where they are recorded on the statement, you may be surprised. Just give us a call at 1-888-409-2227 if you would like to discuss.

Also, with changes in processes and new technologies implemented in the last two months there are shifting expectations. For example, salespeople traditionally need to average at least 11 units per month. Should that now be 15 or 20 with more appointment setting and at home deliveries? Is it time to try a new approach?

List duties by position so you can see if the appropriate person is responsible for those duties. I have heard many stories about indispensable employees and once they were furloughed, it turns out they were not needed in the first place.

As you break out responsibilities verify that highly compensated employees are only doing high level work. If someone at $14 an hour can perform the duties of an $8,000 a month person, they should be performing those tasks. For example, an “A†tech should not be working on reconditioning. By moving duties to the appropriate position, it will free up managers to be better utilized or allow you to work with fewer

managers.

As our dealers have been forced to change, they are seeing surprising results and will be changing processes significantly going forward. Make sure you are making a To Do List to keep implementing these changes. As you work thru your new staffing needs please use the Re-Focus Profit Planner for the listing of your employee head counts and compensation. Also, we have templates to inventory all positions in the dealership

and compare back to where they are recorded on the statement, you may be surprised. Just give us a call at 1-888-409-2227 if you would like to discuss.

May 2020 – Auto Dealer To Do List

Based on April changes, the decisions you make in May, will affect the future of your dealership. The last six weeks have provided a completely new focus on how to move forward.

May 6, 2020

Gross, Market Share & Complete all Tasks.

Gross Margins: Â With limited sales you must maximize gross margins.Â

Â

Read More...

Gross Margins: Â With limited sales you must maximize gross margins.Â

Â

Gross per unit: Â Overhead expense new & used per retail unit usually averages $1,000 per unit. Â If you sell 20% less units, you will need $250 more gross per unit and if you sell 50% less units, you will need $1,000 more gross per unit just to cover overhead.Â

During the crash of 2008, it took many dealers six months to return to profitability, which usually required a gross increase of $1,000 per unit. Â In March 2020 we saw many dealerships increase gross per unit. Â Gross is driven by inventory, location, and your vision. Â As grosses go up, we almost always see either an increase in market share or no change.Â

Â

Market Share: Â Selling processes and marketing has shifted, you must be on the forefront.Â

During the crash of 2008, it took many dealers six months to return to profitability, which usually required a gross increase of $1,000 per unit. Â In March 2020 we saw many dealerships increase gross per unit. Â Gross is driven by inventory, location, and your vision. Â As grosses go up, we almost always see either an increase in market share or no change.Â

Â

Monitor your Competitors: Â The dealers increasing market share will increase their turn and earn, which is imperative with scarce inventory. Â In the last week, I have talked with 3 different dealers that are worried about running out of new inventory. Â Which is another reason to maximize gross. Â

New Sales Process:  Everyone is in a different stage of setting up onâ€line selling and home delivery.  Make sure your team is fine tuning your procedures after each sale and delivery to make sure the process is perfected.  Innovation is key in this market.Â

Market Share is Driven by Inventory: Â In the last 28 years watching market share every month, true changes only occur when inventory changes, not advertising. Â This occurs after tsunamis, hailstorms, new facilities, ownership changes and hurricanes when manufacturers change allocations. Do all you can to make sure you have the correct inventory. Â

Â

Complete all Tasks: Â Â

New Sales Process:  Everyone is in a different stage of setting up onâ€line selling and home delivery.  Make sure your team is fine tuning your procedures after each sale and delivery to make sure the process is perfected.  Innovation is key in this market.Â

Market Share is Driven by Inventory: Â In the last 28 years watching market share every month, true changes only occur when inventory changes, not advertising. Â This occurs after tsunamis, hailstorms, new facilities, ownership changes and hurricanes when manufacturers change allocations. Do all you can to make sure you have the correct inventory. Â

Â

Lost Expertise: Â With your dealership operating with fewer employees, make sure those tasks they specialize in are completed. Â Whether ordering inventory, updating websites, following up with customers, ordering supplies, collecting receivables, paying taxes it is imperative these tasks are completed. Â From my experience, whenever warranty receivables start increasing along with overaged, it always relates to a change with the person, which turns into an expensive problem.Â

New Duties: Â We are all working on additional duties and processes during these times. Â Current employees are now doing the work of additional staff members. Â It is imperative that all staff continue to complete their current tasks in addition to those of others.Â

Dealerships will be much more efficient going forward, but to be profitable now, we must optimize gross. Â Gaining or retaining market share in May will ensure success six months from now, because we will earn the inventory. Â Making sure all the tasks that were assigned to furloughed employees are completed, will have a huge impact on the bottom line. Â These are just a few items, that will make us successful going forward.Â

New Duties: Â We are all working on additional duties and processes during these times. Â Current employees are now doing the work of additional staff members. Â It is imperative that all staff continue to complete their current tasks in addition to those of others.Â

Dealerships will be much more efficient going forward, but to be profitable now, we must optimize gross. Â Gaining or retaining market share in May will ensure success six months from now, because we will earn the inventory. Â Making sure all the tasks that were assigned to furloughed employees are completed, will have a huge impact on the bottom line. Â These are just a few items, that will make us successful going forward.Â